IC Markets in South Africa

Introduction to IC Markets

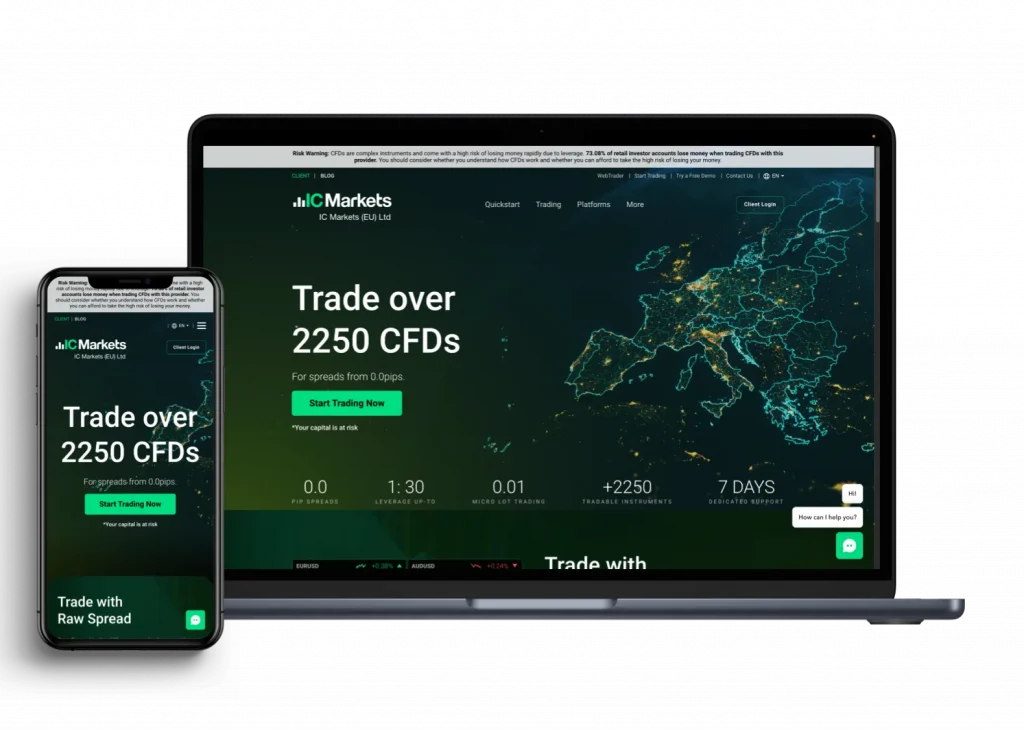

IC Markets operates as a prominent forex and CFD broker, established in 2007. The company maintains strict regulatory compliance through multiple authorities, including ASIC, CySEC, and FSA Seychelles. South African traders access services through the Seychelles entity, ensuring competitive trading conditions while maintaining international standards. The broker processes over 1.64 trillion USD in monthly trading volume, serving more than 200,000 active traders worldwide. Through strategic partnerships with major liquidity providers, IC Markets delivers institutional-grade trading conditions to retail clients.

Trading Account Options

IC Markets presents three account types tailored for different trading requirements:

- Standard Account

- Spreads from 0.8 pips

- No commission charges

- ZAR 3,500 minimum deposit

- Maximum leverage 1:30

- Suitable for beginners

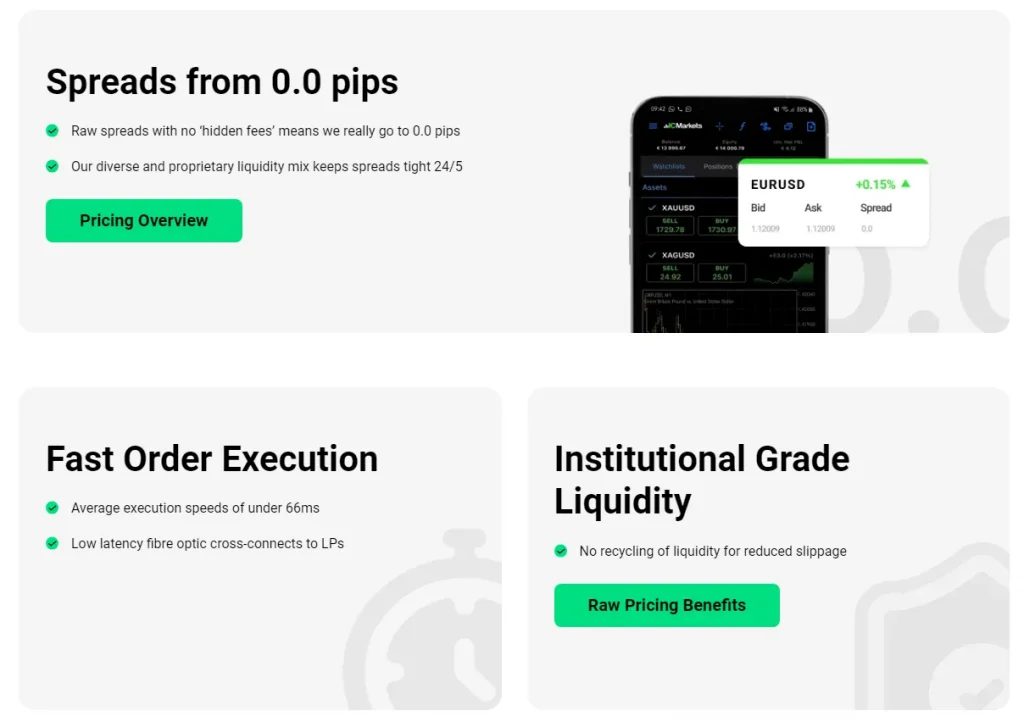

- Raw Spread Account

- Spreads from 0.0 pips

- Commission: $7 per round turn

- ZAR 3,500 minimum deposit

- Ideal for experienced traders

- Advanced trading tools included

- cTrader Raw Account

- Zero pip spreads

- Commission: $6 per round turn

- ZAR 3,500 minimum deposit

- Professional trading environment

- Enhanced execution speed

Trading Platforms and Technology

MetaTrader 4 continues to serve as the industry standard platform, offering sophisticated charting capabilities and Expert Advisor support. The platform integrates seamlessly with mobile devices, allowing traders to maintain market connection regardless of location. Custom indicator creation and multiple timeframe analysis support comprehensive trading strategies.

MetaTrader 5 advances the trading experience with multi-asset capabilities and enhanced analytical tools. The platform incorporates an economic calendar and allows custom dashboard creation. Advanced pending orders and built-in technical indicators provide traders with necessary tools for market analysis and execution.

The cTrader platform presents a modern approach to trading with its sophisticated interface and advanced order types. Level II pricing provides depth of market insight, while automated trading support enables strategy automation. The platform features detachable charts, sentiment indicators, and comprehensive performance analytics.

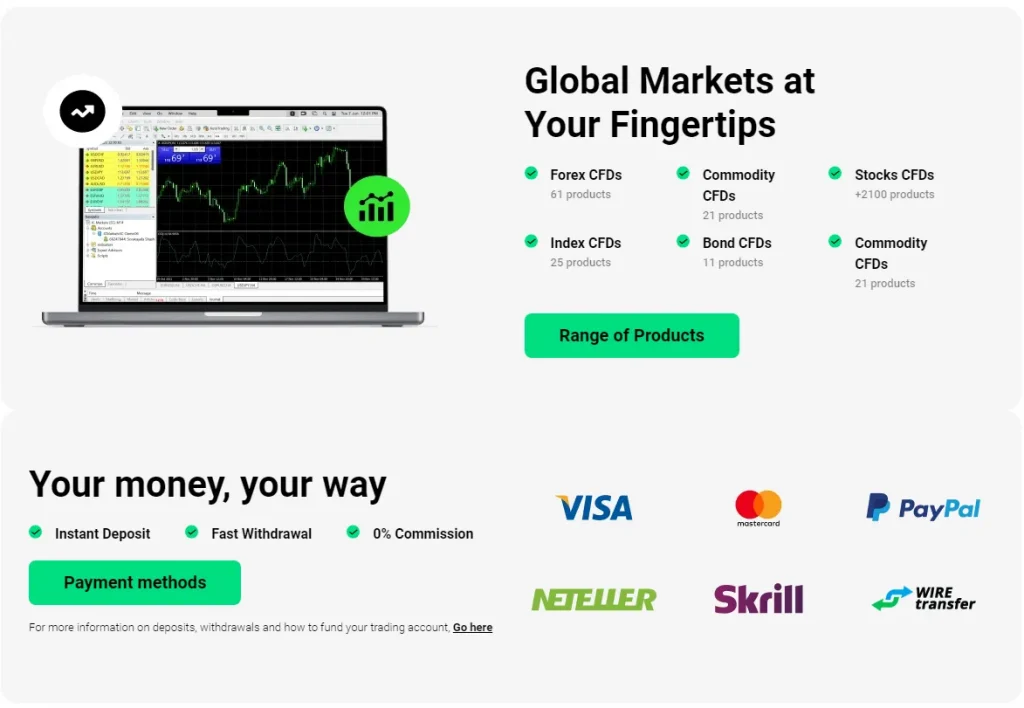

Trading Instruments and Market Access

| Asset Class | Number of Items | Spread Range | Trading Hours | Leverage |

| Forex Pairs | 61 | 0.0-1.2 pips | 24/5 | 1:30 |

| Stock CFDs | 2,100+ | Variable | Market Hours | 1:20 |

| Indices | 25 | 0.5-2.0 points | Extended | 1:20 |

| Commodities | 24 | Variable | Various | 1:20 |

| Cryptocurrencies | 21 | Variable | 24/7 | 1:2 |

| Bonds | 9 | 0.5-2.0 points | Market Hours | 1:5 |

Deposit and Withdrawal Methods

South African traders access a comprehensive range of payment solutions. Bank wire transfers process within 2-5 business days, requiring no deposit fees and maintaining a minimum withdrawal threshold of ZAR 900. The service supports major banks and SWIFT transfers, accommodating both local and international transactions.

South African clients access multiple payment options:

- Bank Wire Transfer

- Processing time: 2-5 business days

- No deposit fees

- Minimum withdrawal: ZAR 900

- Credit/Debit Cards

- Instant processing

- No additional charges

- Major cards accepted

- Electronic Wallets

- Same-day processing

- Multiple providers supported

- Convenient mobile access

Trading Conditions

Trading execution maintains an average speed of 40ms, supported by server locations in Equinix NY4 and LD5 data centers. The platform implements a 100% margin call level and 50% stop out level for risk management. Weekend trading remains available exclusively for cryptocurrency pairs, while other instruments follow standard market hours.

Essential Features:

- Trading Specifications

- Minimum trade size: 0.01 lots

- Maximum trade size: 100 lots

- Position limit: 200 per account

- Hedging allowed: Yes

- Scalping allowed: Yes

- Swap-free options: Available

- Expert Advisors: Supported

- Mobile trading: Available

- Multi-terminal access: Enabled

- Custom indicators: Permitted

User reviews

| Reviewer | Location | Rating | Date | Key Points from Review |

| Jude | GB | 5/5 | Oct 29, 2024 | – Praised support agent Alesia for emergency withdrawal assistance- Highlighted professionalism and patience- Increased trust in IC Markets |

| Artūras Bagdanavičius | LT | 5/5 | Oct 29, 2024 | – Praised low spreads and quick execution- Multiple platform options (MetaTrader, cTrader)- Helpful customer support- Easy to use platform |

| Luca Casale | CA | 5/5 | Oct 28, 2024 | – Raw spreads account with precise entry- Fast and efficient deposits/withdrawals- Kind customer service- Recommends for both beginners and experienced traders |

| George Bonatsos | US | 5/5 | Oct 28, 2024 | – Long-term user (several years)- Quick resolution of archived account issues- Confidence in fund security- Consistent service quality |

| PS | TH | 5/5 | Oct 27, 2024 | – Weekend support availability- Long-term user- Reliable deposit/withdrawal system- Stable MT5 price chart |

Customer Experience Analysis

IC Markets maintains exceptional service standards across all operational aspects. The customer support team operates 24/7, providing assistance in multiple languages with average response times under 5 minutes. Platform stability consistently achieves 99.9% uptime, ensuring reliable trading conditions throughout market hours.

Withdrawal processing adheres to strict security protocols while maintaining efficiency, with most requests completed within 1-3 business days. Account verification procedures balance security requirements with user convenience, typically completing within 24-48 hours. Trading execution maintains industry-leading standards, with minimal slippage and reliable price feeds.

Frequently Asked Questions

South African traders must provide government-issued identification, proof of residence issued within three months, and bank statement verification for account funding.

Weekend trading remains available exclusively for cryptocurrency pairs, while other markets follow standard forex market hours from Monday to Friday.

IC Markets supports automated trading through Expert Advisors on MT4/MT5 platforms, cBots on cTrader, and offers VPS hosting for consistent execution.