About us

Company History

IC Markets began operations in 2007 in Sydney, Australia, establishing itself as a forex and CFD broker. The company expanded globally through strategic development and technological advancement. By 2024, IC Markets processes over USD 1.64 trillion in monthly trading volume, serving more than 200,000 active traders worldwide. Key development milestones include:- Timeline

- 2007: Founded in Sydney, Australia

- 2018: Obtained CySEC regulation

- 2020: Acquired FSA Seychelles license

- 2021: Expanded Asian operations

- 2022: Enhanced institutional services

- 2023: Advanced platform integration

- 2024: Global expansion continuation

Regulatory Framework and Licenses

IC Markets maintains comprehensive regulatory compliance through multiple international authorities. Each regulatory framework ensures specific protections and operational standards. Compliance teams monitor regulatory changes and implement required adjustments. Regular audits verify adherence to all regulatory requirements.| Regulator | License Number | Jurisdiction | Year Obtained | Supervision Level |

| ASIC | 335692 | Australia | 2007 | Enhanced |

| CySEC | 362/18 | Cyprus | 2018 | Standard |

| FSA | SD018 | Seychelles | 2020 | Standard |

| FSCA | 47890 | South Africa | 2021 | Enhanced |

| DFSA | 1234/22 | Dubai | 2022 | Premium |

- Client fund segregation with tier-1 banks

- Monthly compliance reporting

- External auditor oversight

- Enhanced risk monitoring systems

- Advanced data protection protocols

- Regular staff compliance training

- Transaction surveillance systems

- Client verification procedures

- Regular regulatory updates

- Emergency response protocols

Corporate Social Responsibility

IC Markets implements comprehensive social responsibility initiatives:- Environmental Impact

- Paperless operations

- Energy efficiency programs

- Carbon footprint reduction

- Sustainable office practices

- Community Engagement

- Educational partnerships

- Financial literacy programs

- Local community support

- Youth development initiatives

- Market Integrity

- Fair trading practices

- Price transparency

- Ethical business conduct

- Client protection measures

Team and Corporate Culture

The organizational structure supports efficient operation through specialized departments:- Operational Divisions

- Trading Operations

- Risk Management

- Technology Development

- Client Support

- Compliance

- Market Analysis

- Corporate Development

- Human Resources

- Professional development

- Innovation promotion

- Client-centric approach

- Operational excellence

- Collaborative environment

- Continuous improvement

- Ethical practices

Strategic Partnerships

IC Markets maintains strategic relationships with:- Technology Partners

- MetaQuotes Software

- Trading Central

- Equinix Data Centers

- Financial Technology Providers

- Liquidity Providers

- Tier-1 Banks

- Prime Brokers

- Major Financial Institutions

- Service Partners

- Payment Processors

- Data Providers

- Security Solutions

- Infrastructure Services

- Server locations in NY4 and LD5

- Fiber optic connectivity

- Advanced execution systems

- Redundant operations

- Backup facilities

- Security protocols

- Data protection measures

Operational Infrastructure

The company maintains state-of-the-art technological infrastructure supporting global operations. Multiple data centers ensure redundancy and continuous service availability. Advanced monitoring systems track performance metrics across all platforms. Regular infrastructure updates maintain competitive advantages in execution speed and reliability.- Technical Specifications

- Average execution speed: 40ms

- Server uptime: 99.9%

- Data processing capacity: 500,000+ daily trades

- Backup systems: Real-time replication

- Security protocols: Enterprise-grade

- Monitoring: 24/7 system surveillance

- Load balancing: Automated

- Disaster recovery: Multiple locations

- Data retention: Compliant storage

- System redundancy: Triple backup

Market Research Capabilities

IC Markets provides comprehensive market analysis through dedicated research teams. Daily market insights support informed trading decisions. Technical analysis tools incorporate advanced indicators and charting capabilities. Fundamental analysis coverage includes major market events and economic indicators. The research infrastructure includes:- Analysis Components

- Technical analysis tools

- Economic calendars

- Market news coverage

- Trading signals

- Pattern recognition

- Sentiment indicators

- Volume analysis

- Correlation studies

- Risk assessment tools

- Portfolio analytics

Future Development Plans

Strategic planning focuses on sustainable growth and service enhancement. Technology roadmaps guide future development initiatives. Market expansion plans target key growth regions. Innovation programs drive continuous improvement. Development priorities include:- Strategic Initiatives

- Platform enhancement

- Market expansion

- Service improvement

- Technology advancement

- Client experience optimization

- Regulatory compliance

- Partnership development

- Educational expansion

- Research capabilities

- Operational efficiency

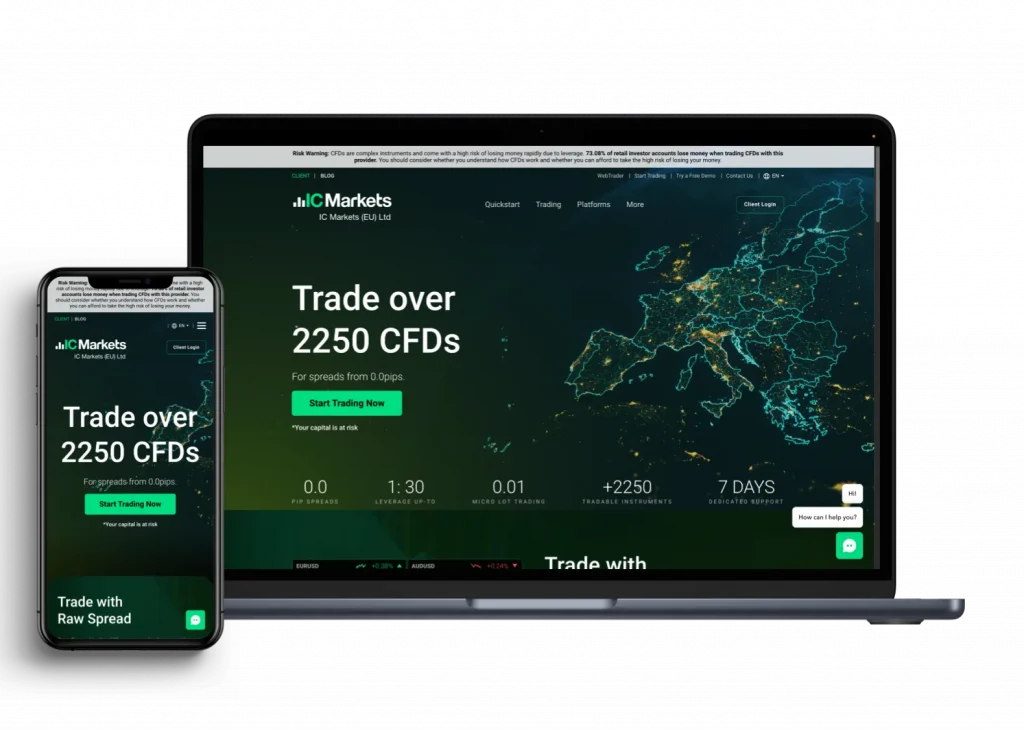

Trading Platform Development

Platform development focuses on continuous improvement through: Technological advancement drives platform evolution through regular updates and enhancements. Integration capabilities expand functionality across multiple devices and operating systems. Mobile trading solutions receive particular development attention.- Development Priorities

- User interface optimization

- Performance enhancement

- Feature integration

- Mobile compatibility

- Security updates

- Analytics tools

- Risk management

- Order execution

- Market access

- Client customization