Trading Leverage IC Markets

Leverage Overview

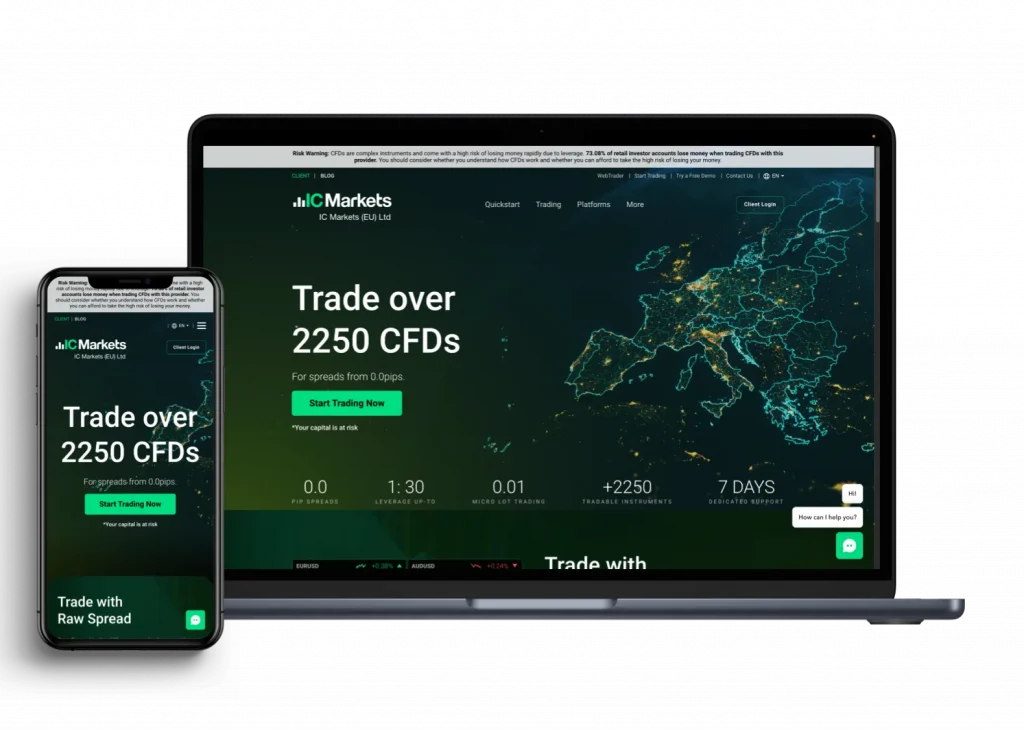

IC Markets provides flexible leverage options for South African traders up to 1:500. Leverage availability varies by account type and trading instrument selection. Trading conditions maintain consistency across all leverage ratios. Each leverage option requires specific margin requirements and account verification.

Leverage Structure

Standard accounts access leverage ratios from 1:1 to 1:500. Professional accounts maintain similar leverage options with enhanced conditions. Margin requirements scale with selected leverage ratios. Support assists with leverage selection.

Available Leverage Options

| Account Type | Maximum Leverage | Min Deposit (ZAR) | Margin Call |

| Standard | 1:500 | 2000 | 100% |

| Raw Spread | 1:500 | 2500 | 100% |

| Professional | 1:500 | 5000 | 100% |

Margin Requirements

- Margin Levels

- Initial margin

- Maintenance margin

- Margin calls

- Stop out levels

- Free margin

- Used margin

- Margin ratio

- Available margin

- Equity level

- Balance status

Ratio Selection

Leverage selection depends on trading strategy and risk management. Higher ratios require increased margin maintenance. Position sizes adjust with leverage selection. Support provides leverage guidance.

Risk Management Tools

- Protection Features

- Stop loss orders

- Take profit settings

- Margin monitors

- Position sizing

- Risk calculators

- Exposure alerts

- Portfolio analysis

- Leverage warnings

- Balance protection

- Emergency closes

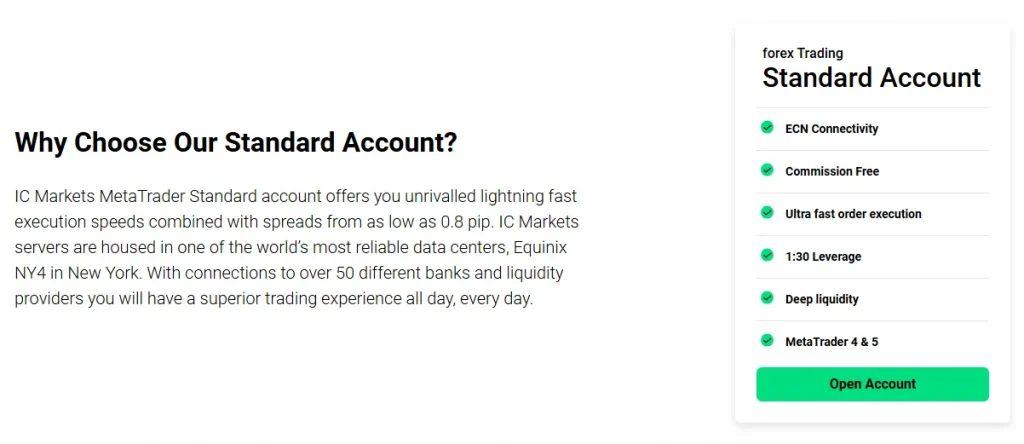

Margin Calculations

Margin requirements calculate automatically based on position size. Trading platforms display current margin levels continuously. Alert systems notify of margin changes. Support assists with margin queries.

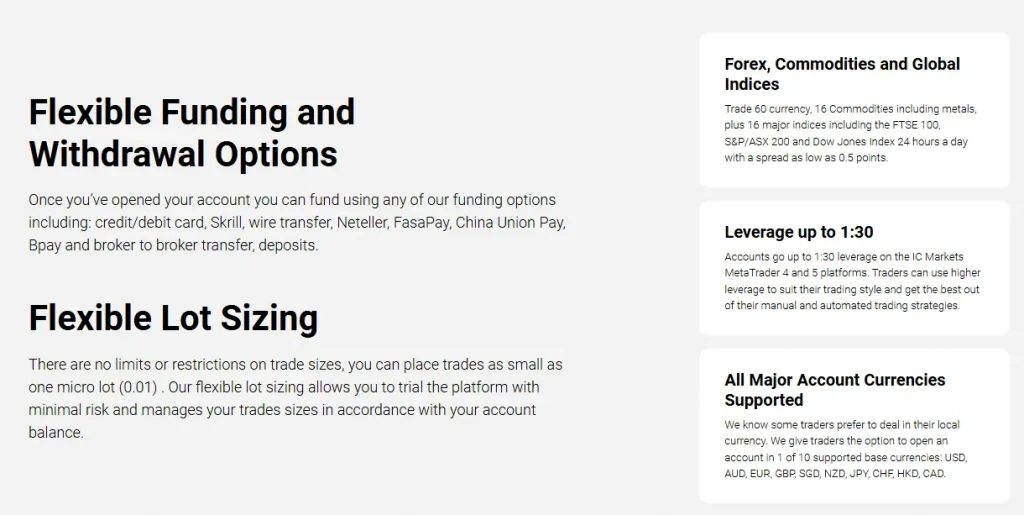

Regional Trading Conditions

South African traders access specific leverage options aligned with local regulations. Market hours accommodate regional trading patterns. Support services understand local requirements. Trading conditions maintain regional compliance.

Local Requirements

Regional verification processes ensure proper documentation. Local banking systems support efficient funding. Support teams understand regional needs. Market access maintains local standards.

Protection Systems

Risk management tools ensure account protection at all leverage levels. Monitoring systems track margin usage continuously. Alert systems provide early warnings. Support responds to risk queries promptly.

Trading Instrument Leverage

| Instrument | Max Leverage | Margin Requirement | Trading Hours |

| Forex Majors | 1:500 | 0.2% | 24/5 |

| Commodities | 1:200 | 0.5% | Market hours |

| Indices | 1:100 | 1% | Market hours |

Instrument Specifications

Different instruments maintain specific leverage limitations. Margin requirements vary by instrument type. Trading conditions adjust with market hours. Support provides instrument details.

Level Requirements

Account levels determine available leverage options. Verification requirements scale with account types. Feature access expands with account levels. Support guides level selection.

Platform Integration

- Leverage Tools

- Calculator access

- Position monitors

- Margin displays

- Risk indicators

- Balance trackers

- Equity monitors

- Level adjusters

- Alert systems

- Status updates

- Emergency tools

Technical Features

- Trading platforms display leverage information clearly. Tool integration maintains consistency across platforms. Monitoring systems track leverage usage. Support assists with platform queries.

Leverage Adjustment Process

Leverage changes process through account management systems. Adjustment requests require verification checks. Processing times maintain efficiency standards. Support assists with adjustment procedures.

Change Requirements

Documentation needs vary by leverage level request. Verification processes ensure account safety. System updates reflect changes immediately. Support guides adjustment processes.

Corporate Leverage Options

- Business Features

- Custom ratios

- Special conditions

- Enhanced tools

- Priority support

- Risk management

- Advanced monitors

- Custom reports

- Special access

- Direct handling

- Emergency support

Market Execution Systems

- Execution Features

- Order types

- Fill rates

- Slippage control

- Speed optimization

- Price improvement

- Order routing

- Execution reports

- Status tracking

- Error prevention

- Recovery options

Business Requirements

Corporate accounts access specialized leverage options. Documentation requirements follow business standards. Processing maintains enhanced security. Support provides dedicated assistance.

System Performance

Execution systems maintain reliability at all leverage levels. Processing speeds remain consistent across order types. Monitoring ensures execution quality. Support responds to execution queries.

Customization Options

- Personal Settings

- Interface layout

- Tool arrangement

- Alert configuration

- Report formats

- Display options

- Chart settings

- Analysis tools

- Trading panels

- Monitor views

- Access controls

Platform Settings

Customization options support individual trading styles. Settings save automatically across sessions. Configuration tools maintain user preferences. Support assists with setup procedures.

FAQ

Access account management, select desired leverage, submit required verification, and await approval within 24 hours.

System alerts notify at 100% margin level, requiring immediate action to either deposit funds or reduce positions.

Yes, IC Markets may adjust leverage during high volatility periods or major market events, with prior notification to traders.