IC markets minimum deposit in ZAR

Deposit Requirements Overview

IC Markets provides multiple deposit options for South African traders in ZAR currency. Minimum deposit requirements start from 2000 ZAR for standard accounts. Each account type maintains specific deposit thresholds for feature access. Payment processing follows South African banking regulations.

Initial Deposit Structure

Standard accounts require 2000 ZAR minimum deposit through most payment methods. Raw Spread accounts start from 2500 ZAR for enhanced trading conditions. Professional accounts need 5000 ZAR initial deposit. Corporate accounts maintain higher requirements.

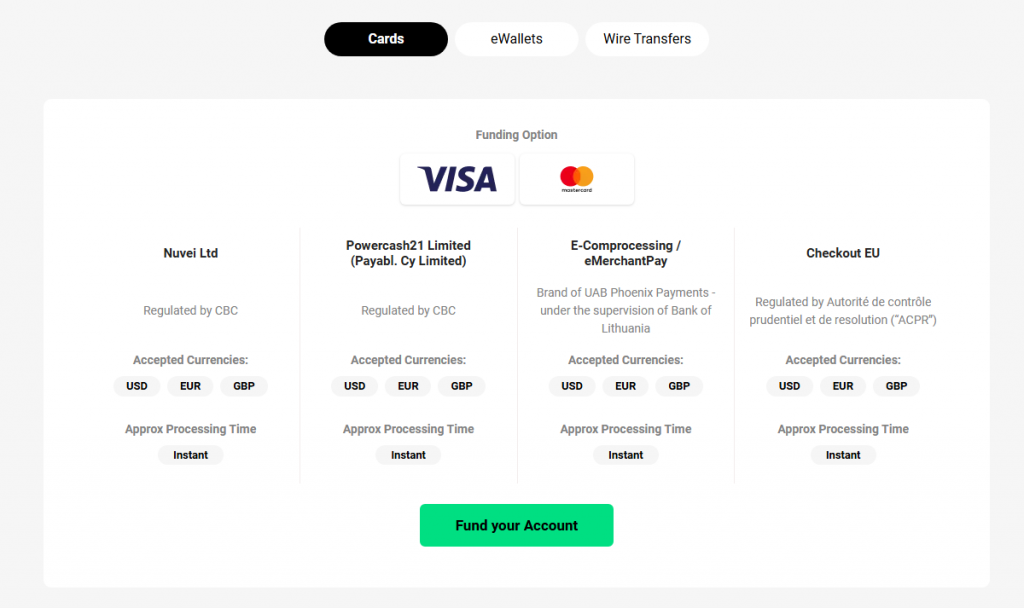

Payment Methods

| Method | Minimum (ZAR) | Processing Time | Fees |

| Bank Transfer | 2000 | 1-2 days | Bank dependent |

| Credit Card | 2500 | Instant | 0-2.5% |

| E-wallet | 2000 | Instant | Provider fees |

| Crypto | 3000 | 2-6 hours | Network fees |

Local Banking Integration

South African bank transfers process during business hours. Standard processing times range from 1-2 business days. Bank fees vary by institution and transfer amount. Verification requirements follow local banking regulations.

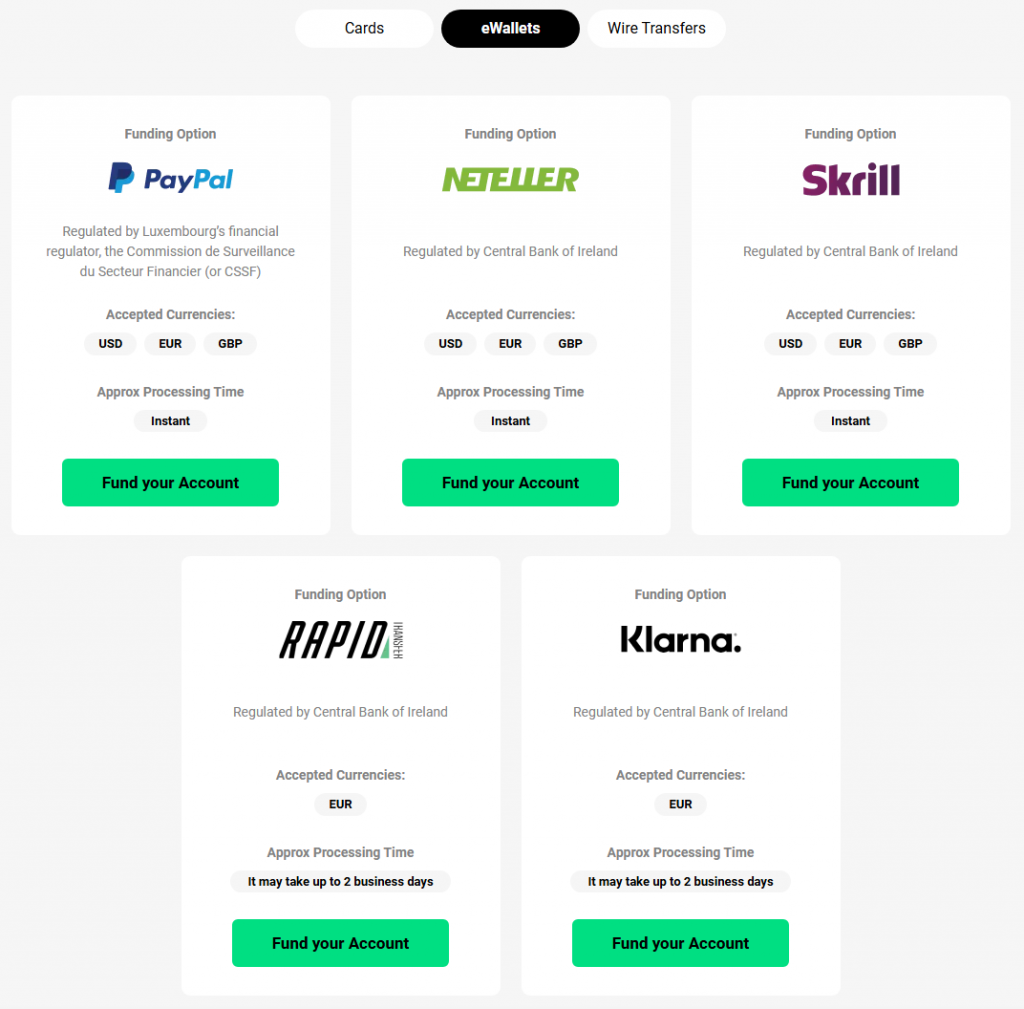

Electronic Payment Options

- Available E-payments

- Instant EFT

- Credit cards

- Debit cards

- E-wallets

- Mobile payments

- Internet banking

- Digital transfers

- Payment apps

Processing Times

Electronic payments provide instant account crediting upon verification. Security measures verify all electronic transactions. Processing fees vary by payment method selection. Support assists with electronic payment queries.

Account-Specific Requirements

| Account Type | Minimum (ZAR) | Features | Trading Conditions |

| Standard | 2000 | Basic | Standard spreads |

| Raw Spread | 2500 | Enhanced | Raw spreads |

| Professional | 5000 | Premium | Advanced tools |

| Corporate | 10000 | Custom | Dedicated support |

Verification Process

- Required Documents

- South African ID

- Proof of residence

- Bank statement

- Income verification

- Tax number

- Employment proof

Processing Steps

Verification typically completes within 24 hours. Additional requirements may extend processing time. Support assists with verification procedures. Document updates maintain account compliance.

Feature Access

Initial deposit amounts determine available trading features. Higher deposits unlock additional account benefits. Premium services require maintained deposit levels. Support provides feature activation assistance.

Corporate Deposits

Business accounts maintain higher minimum deposit requirements. Documentation verification follows regulatory standards. Processing includes additional security measures. Support provides specialized assistance.

Currency Management

Currency conversion processes maintain transparency. Exchange rates update continuously during market hours. Conversion fees apply to non-ZAR deposits when necessary. Multiple currency accounts provide trading flexibility.

Security Protocols

- Protection Measures

- Transaction encryption

- Access verification

- Activity monitoring

- Fraud prevention

- Data protection

- System backups

- Alert systems

- Emergency protocols

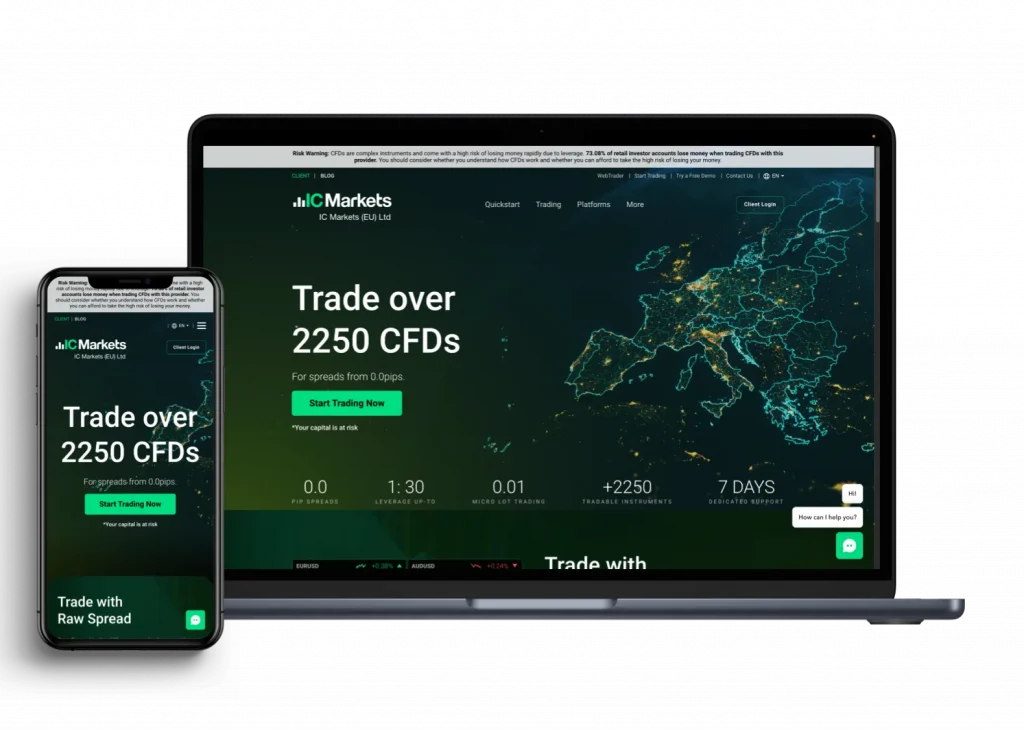

Mobile Deposit Features

Mobile platform access supports various deposit methods for South African traders. Security protocols maintain protection during mobile transactions. Integration with local payment systems provides convenient funding options. Platform features adapt to mobile device capabilities.

Mobile Functions

Instant deposits

QR code payments

Biometric security

Transaction history

Payment tracking

Status updates

Account monitoring

Alert settings

Support access

Emergency features

Mobile Security

Mobile deposits implement enhanced security measures for protection. Verification processes adapt to mobile platform requirements. System monitoring tracks mobile transaction patterns. Support provides specialized mobile assistance.

Deposit Processing Systems

Processing infrastructure maintains efficient operation for all payment methods. Security systems verify transactions through multiple checkpoints. Integration with local banking networks ensures reliable processing. Support monitors transaction status continuously.

Transaction Monitoring

Monitoring systems track all deposit activities in real-time. Status updates provide transaction progress information. Security protocols verify payment authenticity. Support responds to processing queries promptly.

Premium Deposit Services

- Enhanced Features

- Priority processing

- Dedicated support

- Higher limits

- Custom solutions

- VIP services

- Direct assistance

- Special rates

- Extended hours

- Emergency support

- Personal manager

VIP Processing

Premium accounts receive priority deposit processing attention. Dedicated support assists with transaction requirements. Enhanced security measures protect larger deposits. Processing updates maintain regular communication.

Regional Banking Integration

South African banking partnerships facilitate efficient deposits. Local bank processing follows established protocols. Integration systems maintain reliable operation. Support provides regional banking assistance.

- Banking Features

- Local transfers

- Bank partnerships

- Network access

- Processing systems

- Security protocols

- Status tracking

- Update services

- Error prevention

- Recovery options

- Emergency support

FAQ

Standard accounts require 2000 ZAR minimum deposit through bank transfers or e-wallets.

Bank transfers take 1-2 business days, while electronic payments process instantly after verification.

Bank transfer fees depend on your bank. Electronic payments may include provider fees ranging from 0-2.5%.